texas estate tax calculator

An estate tax is a tax imposed on the total value of a persons estate at the time of their death. Loading Do Not Show Again Close.

Texas Estate Tax Everything You Need To Know Smartasset

Denton TX 76201-4168 Phone Directory.

. The median property tax on a 10180000 house is 106890 in the United States. Enter the value of your property. 1 The type of taxing unit determines which truth-in-taxation steps apply.

From Fisher Investments 40 years managing money and helping thousands of families. Enter your Over 65 freeze amount. Government Websites by CivicPlus Calculate an estimate of your property taxes.

Enter your Over 65 freeze amount. The Property Tax Estimator will show you the estimated taxes assessed in a given area of Travis County. Please choose your exemption.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. You are able to use our Texas State Tax Calculator to calculate your total tax costs in the tax year 202122. The property tax is used to finance the States 254 counties over 1200 cities 1022 independent school districts and more than 1800 special districts.

2160 of Assessed Home Value. It is sometimes referred to as a death tax Although states may impose their own estate taxes in the United States this calculator only estimates federal estate taxes. Public Notice Denton County facilities closed through Thursday due to inclement weather Read The News Release Disaster Declaration Related to COVID-19.

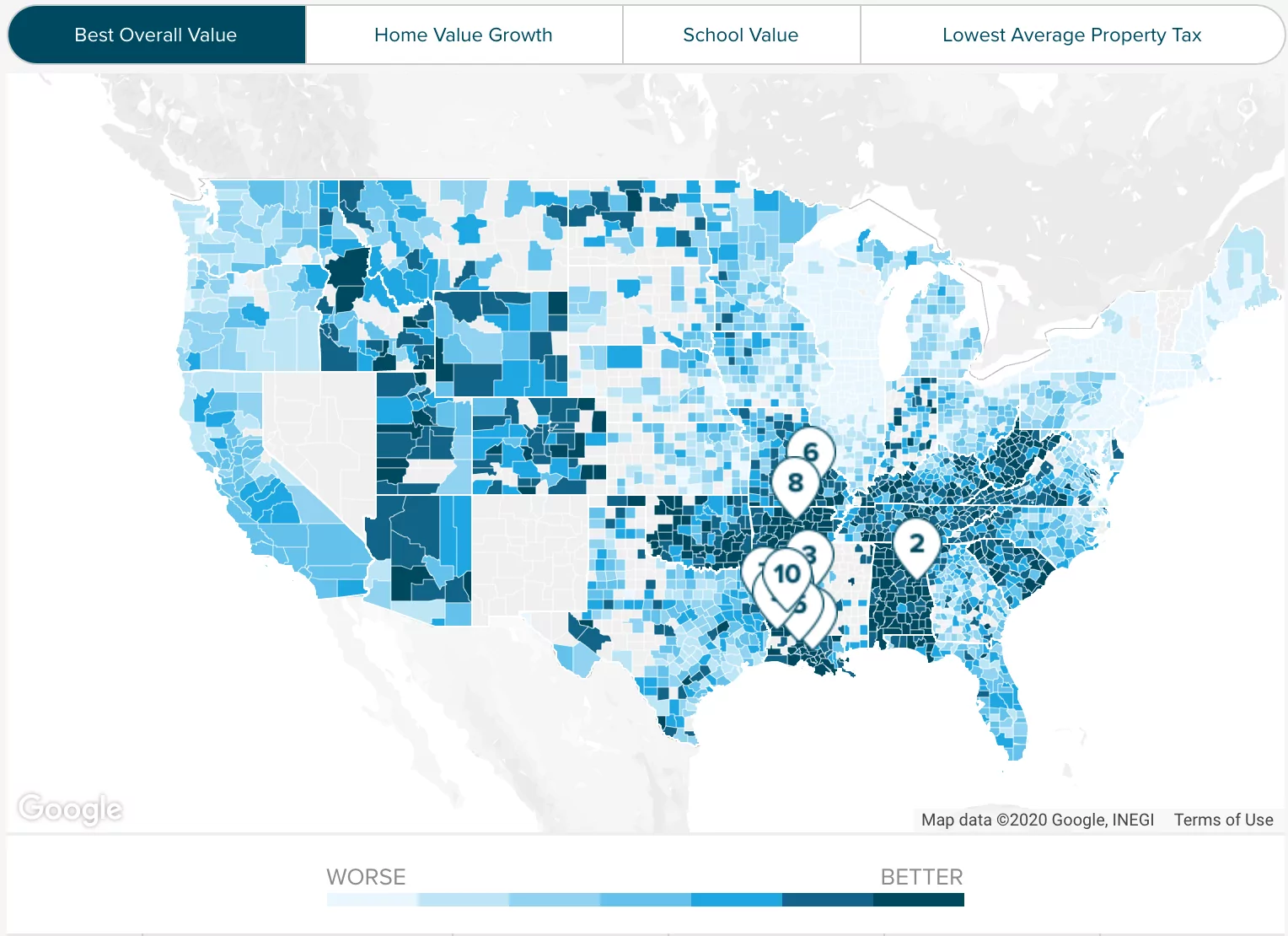

County and School Equalization 2022 Est. Your average tax rate is 169 and your marginal tax rate is 297This marginal tax rate means that your immediate additional income will be taxed at this rate. Thats nearly double the national average of 107.

The median property tax on a 12970000 house is 136185 in the United States. 2018 Estate Tax Calculator. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in El Paso County.

Annual How Your Property Taxes Compare Based on an Assessed Home Value of 250000. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in. Texas has a 625 statewide sales tax rate but also has 815 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1345 on top.

If you make 55000 a year living in the region of Texas USA you will be taxed 9295That means that your net pay will be 45705 per year or 3809 per month. The median property tax on a 11800000 house is 213580 in Texas. After the passage of the tax bill last year many clients felt that with the increased exemption they no longer had an estate tax liability.

Enter your Over 65 freeze year. TAX DAY NOW MAY 17th - There are -284 days left until taxes are. TurboTax Is Designed To Help You Get Your Taxes Done.

This amount changes each tax year but is determined in accordance with state law. This calculator can only provide you with a rough estimate of your tax liabilities based on the property. To estimate your real estate taxes you merely multiply your homes assessed value by the levy.

Over 65 or Surviving Spouse. Overview of Harris County TX Taxes. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property. Start filing your tax return now. Enter your Over 65 freeze year.

The median property tax on a 10180000 house is 184258 in Texas. The property tax in Texas applies to all real property and some tangible personal property in the state. Ad Free For Simple Tax Returns Only.

Please select your county. Calculator is designed for simple accounts. Please select your school.

The median property tax on a 12970000 house is 234757 in Texas. In Harris County the most populous county in the state the average effective property tax rate is 203. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

Our Texas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Texas and across the entire United States. Skip to Main Content. What many of our clients do not know is that in 2026 the unified credit is scheduled to.

Tax Rate City ISD Special District Hospital College General Homestead. Rate information for all jurisdictions in accordance with Texas Property Tax Code Section 2616 is available at TravisCountyTXgov. 2100 of Assessed Home Value.

Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval tax rate. Please select your city. Harris County TX Property Tax Calculator.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The median property tax on a 11800000 house is 123900 in the United States. Cities counties and hospital districts may levy a sales tax specifically to reduce property taxes.

The state of Texas has some of the highest property tax rates in the country. The median property tax on a 12970000 house is 282746 in Dallas County. The median property tax on a 11800000 house is 160480 in Smith County.

Get Your Maximum Refund When You E-File With TurboTax.

Texas Estate Tax Everything You Need To Know Smartasset

Texas Income Tax Calculator Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

Income Tax Calculator 2020 2021 Estimate Return Refund

Texas Income Tax Calculator Smartasset

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Texas Income Tax Calculator Smartasset